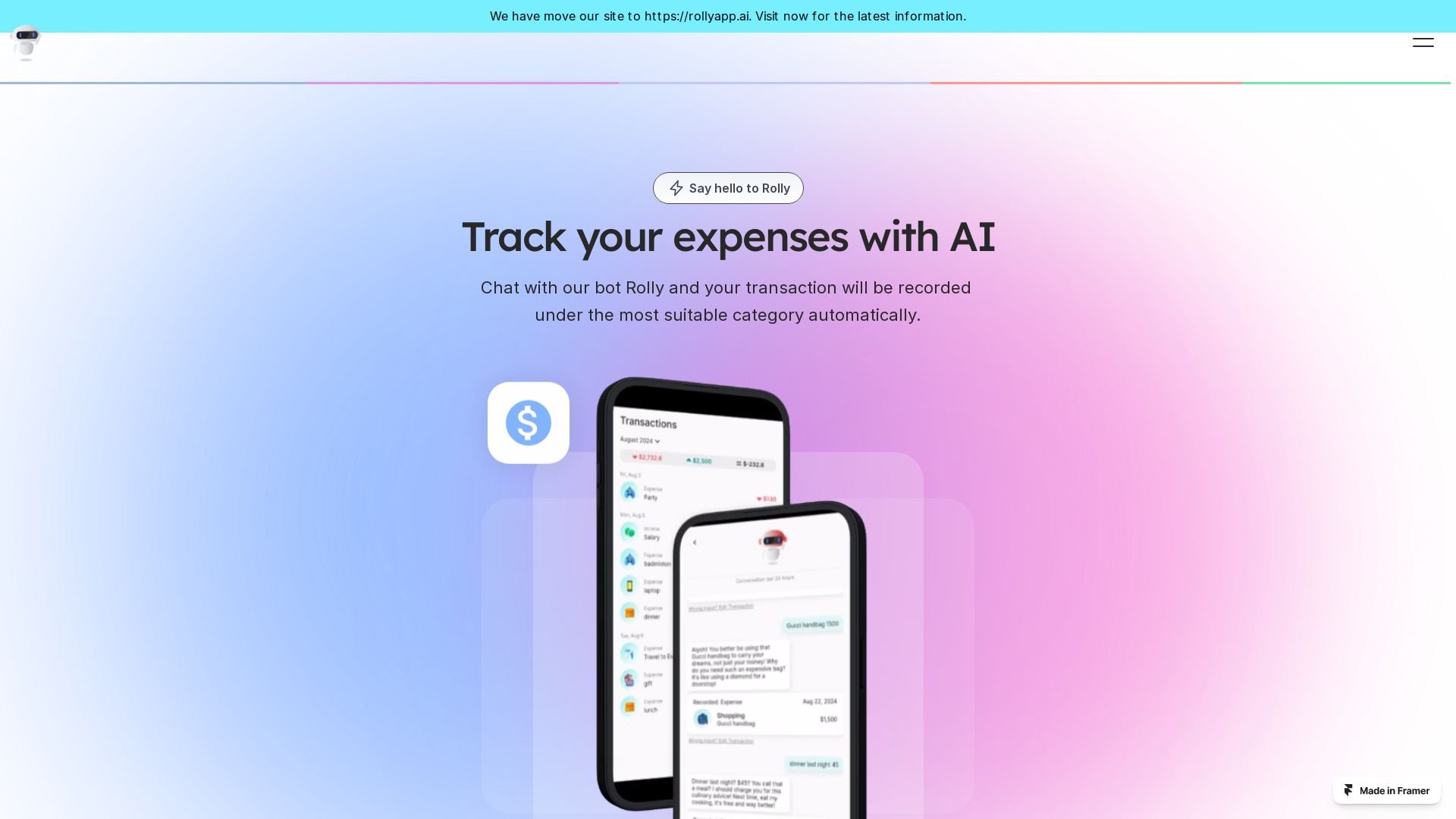

Rolly is an AI-powered tool designed to revolutionize personal finance management by automating the tracking and categorization of income and expenses. By leveraging advanced AI, Rolly simplifies financial monitoring and provides users with clear insights into their spending habits. Its chatbot-based interface allows users to communicate their transactions directly, which are then intuitively logged and categorized, making the financial management process seamless and efficient.

Transaction Logging via Chatbot: Users report transactions to Rolly's chatbot, which automatically records and categorizes them, ensuring accuracy and simplicity.

Automated Categorization: Rolly dynamically categorizes transactions and allows users to create or edit categories, ensuring every transaction is sorted into the most appropriate group.

Visual Insights: Rolly generates insightful charts that provide a clear visual representation of spending patterns, helping users analyze their financial health.

Multi-Lingual Support: Users can interact with Rolly in their preferred language, enhancing accessibility and user comfort.

Engaging Interactions: Rolly adds a personal touch by offering interactive, sometimes humorous, comments based on the user’s transactions and 'mood.'

AI-Driven Transaction Logging: Automatically log and categorize income and expenses through an intuitive chatbot interface.

Customizable Categories: Adapt transaction categories to fit your unique financial needs, ensuring precise categorization.

Visual Spending Analytics: Analyze your spending habits through aesthetically pleasing charts that break down monthly or overall expenses.

Multi-Lingual Support: Interact with Rolly in any language, making it accessible for users worldwide.

Engaging Interactions: Rolly not only helps track finances but also engages with users through comments on their spending, making the experience more enjoyable.

Busy Professionals: Automatically track and categorize income and expenses, saving time and reducing the effort of manual finance management.

Families: Keep track of household expenses and receive visual breakdowns of spending patterns to help manage family budgets more efficiently.

Freelancers: Easily log income and expenditures in multiple categories and visualize your earnings and costs over time for better financial control.

Can Rolly handle different currencies and languages? Yes, Rolly supports multiple currencies and languages, making it versatile for users around the globe.

Does Rolly provide customizable categories? Yes, you can create and modify categories to suit your specific financial tracking needs.

Rolly transforms personal finance management from a tedious task into a simple, automated, and even enjoyable process. Its powerful AI capabilities, combined with an engaging user interface, ensure that users can effortlessly stay on top of their financial health.