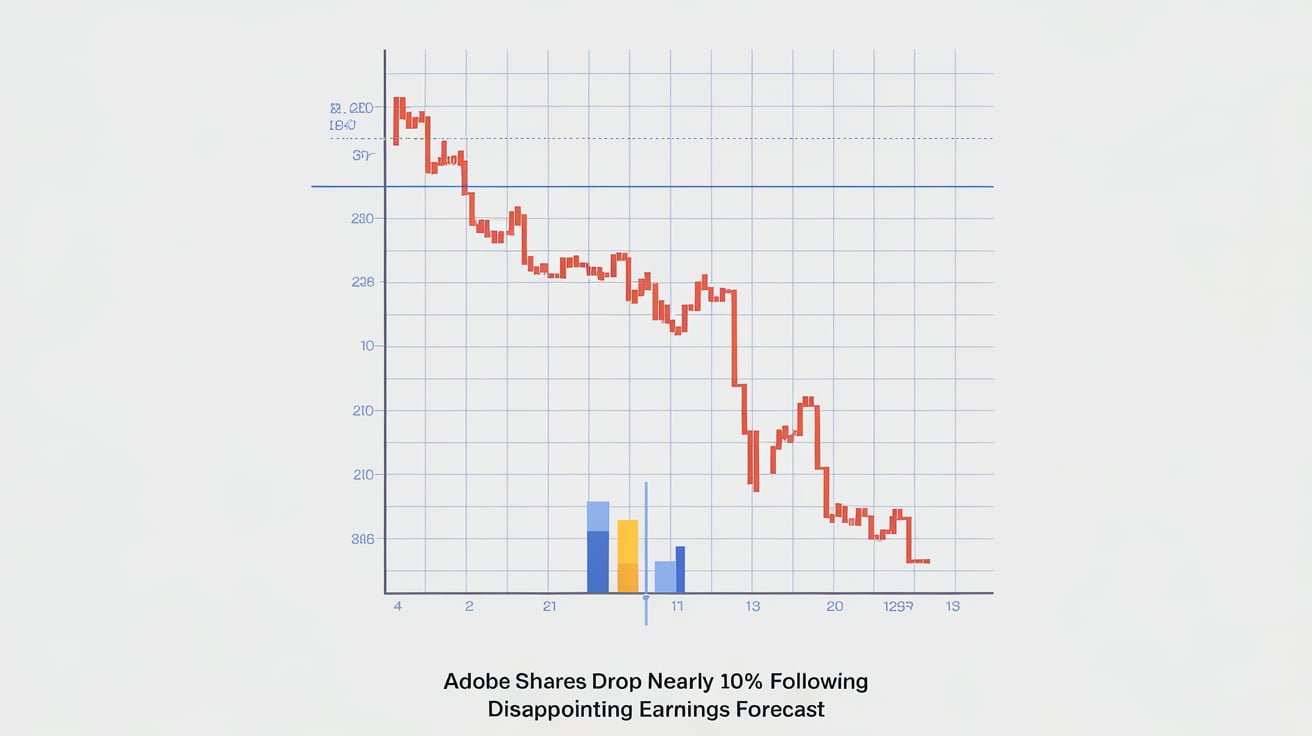

Shares of Adobe fell nearly 10% on Friday, driven by the company’s disappointing quarterly earnings forecast. Adobe, known for its flagship product Photoshop, has been investing heavily in AI-driven image and video generation to stay competitive amidst rising challenges from well-funded startups like Stability AI and Midjourney.

On Thursday, Adobe projected fourth-quarter revenue between $5.50 billion and $5.55 billion, falling short of the $5.61 billion anticipated by analysts surveyed by LSEG. The company's forecasted quarterly profit, excluding items, is expected to range from $4.63 to $4.68 per share, compared to the $4.67 per share estimated by analysts.

If these projections hold, Adobe could see a market value reduction of over $25 billion. This decline follows a year where Adobe’s shares had risen over 77% in 2023 but have now fallen nearly 2% year-to-date.

Despite the lower revenue and profit forecast for the fourth quarter, Adobe remains optimistic about surpassing its annual net new recurring revenue (NNARR) expectations, indicating robust subscription sign-ups. JP Morgan analysts noted that Adobe is expected to achieve year-on-year growth in Creative Cloud NNARR and is among the few software companies showing growth in net-new bookings.

However, the weak earnings forecast suggests ongoing pressure in the buying environment. Bernstein analysts highlighted that Adobe might lack immediate catalysts for stock recovery unless the company can convincingly demonstrate stronger growth prospects for the next year.