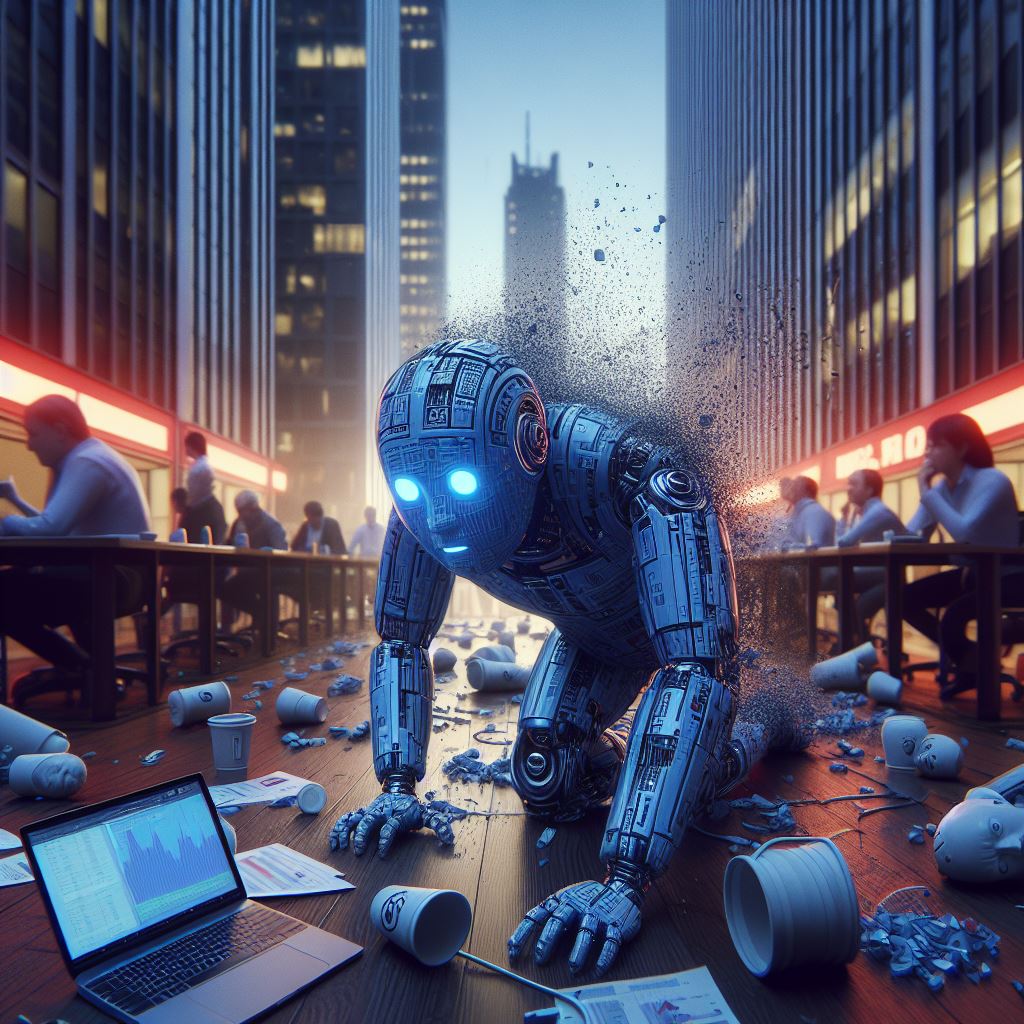

Late on Tuesday, AI-related companies witnessed a staggering $190 billion loss in stock market value following underwhelming quarterly results from tech giants Microsoft, Alphabet, and Advanced Micro Devices (AMD). The lackluster performance prompted a significant selloff, highlighting investors' heightened expectations following a recent AI-driven stock market rally.

The post-earnings selloff underscored the market's lofty expectations fueled by the promise of integrating AI technology across various sectors, propelling stock prices to record highs in recent months.

Alphabet, the parent company of Google, experienced a 5.6% drop after its December-quarter ad revenue fell short of expectations. The company also announced an increase in spending on data centers to support its AI initiatives, reflecting the intense competition with AI rival Microsoft.

While Google Cloud's revenue growth slightly surpassed Wall Street targets, Microsoft's Azure platform demonstrated faster growth. Microsoft, despite beating analyst estimates for quarterly revenue with the aid of new AI features attracting customers to its cloud and Windows services, saw its stock decline by 0.7% in extended trading, briefly hitting an intra-day record high earlier in the day.

Microsoft's optimistic outlook on AI recently propelled its stock market value above $3 trillion, surpassing that of Apple.

Chipmaker Advanced Micro Devices (AMD) experienced a 6% tumble after its first-quarter revenue forecast missed estimates, despite projecting strong sales for its AI processors.

Shares of Nvidia, which surged 27% in January and more than tripled in value last year on AI optimism, also saw a decline in extended trading, down over 2%.

Server maker Super Micro Computer, benefiting from increased demand related to AI, witnessed a drop of over 3% after reaching a record high earlier in the day, following impressive quarterly results.

The collective downturn in AI-related stocks reflects the market's reaction to the performance of key players in the sector and underscores the ongoing volatility driven by investor expectations in the rapidly evolving AI landscape.